MTN Ghana partners with Access Bank to offer smartphones to customers on flexible payment service MTN Ghana...

Business

WordPress is a favorite blogging tool of mine and I share tips and tricks for using WordPress here.

The Electricity Company of Ghana (ECG) has issued an urgent notice to customers using Nuri Prepaid Meters,...

By Sam Bediako Asante, Investment Consultant on gbconline.com Most bad financial decisions stem from emotional reactions, lack...

How to Make Money with Stock Photography: A Beginner’s Guide If you’re someone whose phone gallery is...

How Much Do Lawyers Charge in Ghana? Fees for Different Cases and Tips to Pay Less The...

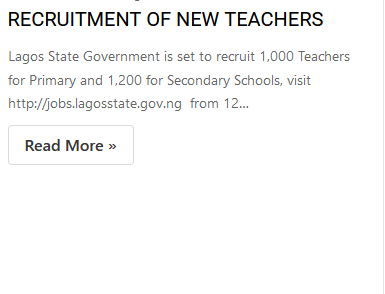

Lagos State Government Recruitment for Secondary School Classroom Teachers RECRUITMENT OF NEW TEACHERS Stay informed...

2024 List of Successful Candidates for 86RRI Nigerian Army To View the List of Successful candidates...

Nigerian Army Recruitment Portal opened 2024 Nigerian Army Recruitment 2024/2025 86RRI www.army.mil.ng The Nigerian Army Recruitment Portal...

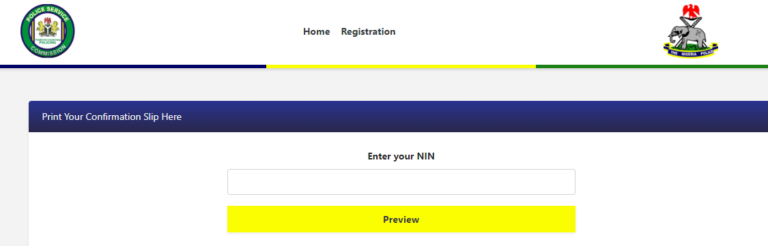

How to print police recruitment invitation slip 2024 How to print police recruitment invitation slip? Here is...

Nigerian Police Recruitment 2024 Portal NPF Do you want to be a Police officer in Nigeria? Here’s...