Ghana Immigration Service recruitment: Applicants to report for body selection, document assessment and medical screening The recruitment...

Recruitment Portal / Declared Vacancies

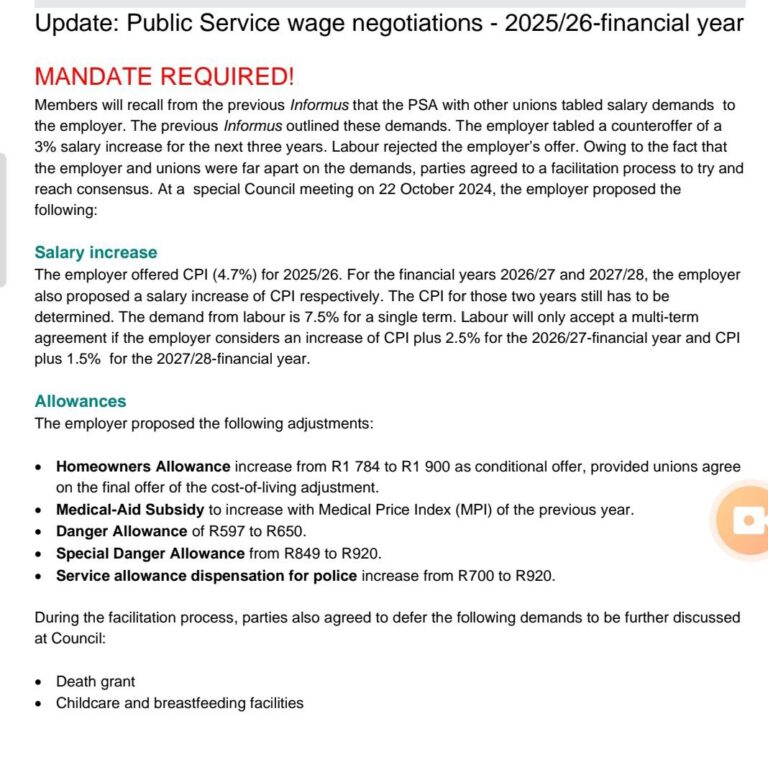

2025 Public Sector Wage Negotiations Gov Offers 4.7% for 3 Years Down of 12% Demand South Africa:...

Here’s a comparison of data analyst salaries in the ten countries you specified: Ghana, UK, USA, Germany,...

Ghana Average Salary: GHS 4,000 – GHS 15,000 per month (approx. $184 – $931) United Kingdom Average...

Here’s a breakdown of the annual salaries of presidents and equivalent heads of state in the specified...

Here’s a summary of police salaries in the these countries: 1. Ghana Average Salary: Approximately GHS 2,800...

Ghana Salary Range: GHS 3,500 – GHS 5,000 per month (approximately USD 225 – USD 332) Factors:...

Teacher’s Salary in 10 Countries “Welcome back to the channel! Today, we’re diving into how much teachers...

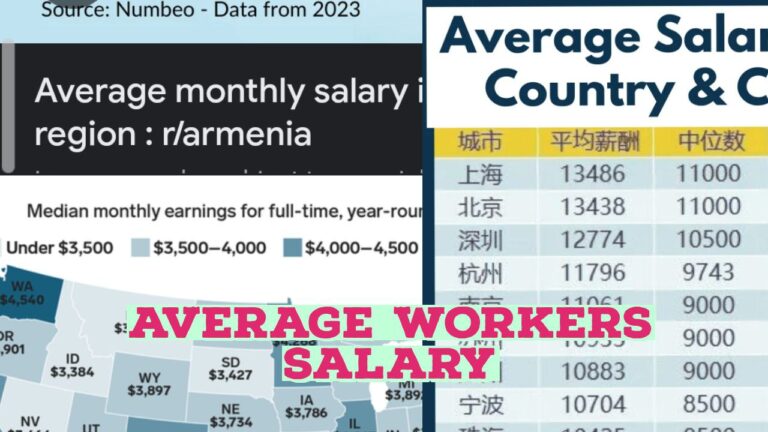

Average Salary of workers in top 10 countries Here’s an average salary comparison for various countries across...

Top Allowances Given to Workers Workers often receive various allowances from companies or governments to supplement their...