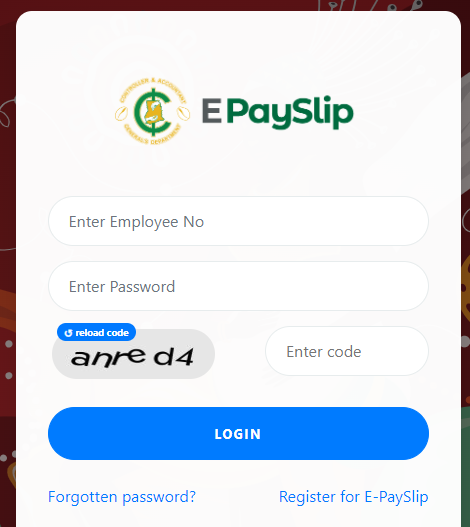

GOGPAYSLIP E-Payslip Login Portal Guide

Welcome to the GOGPAYSLIP E-Payslip Login Portal. This secure link from the Controller and Accountant General’s Department allows you to log in and access your payslip.

How to Check and Download This Month’s Payslip:

- Enter Employee Number: Your Employee Number is the same as your Staff ID.

- Enter Password

- Provide Code as Seen

- Click Login

Note: Ensure the link you enter is always secure. Check the top URL to make sure the lock icon is closed.

Accessing the Portal:

- Go to Your Web Browser

- Search “GoG E-Payslip Portal”

- Check the Logo and Ensure the Site is Secured

Alternatively, use the direct link: https://www.gogpayslip.com/index.php?action=login The URL must always start with “https” to ensure it is secure.

FOR CAGD LOAN CONTACT SEEKERS CONSULT TO LINK YOU UP WITH MULTIPLE FINANCIAL INSTITUTIONS 0550414552.

AND FOR YOUR TRANSCRIPTS AND ENGLISH PROFICIENCY LETTER FROM UNIVERSITIES IN GH.

Trusted and reliable

If you can’t Login See the Controller officer in your Region for Assistance. The Main Portal is a website and hence can go down for upgrading and maintenance, No need to Worry if the site is down.

Teaching Jobs in Canada and Salaries with Sponsored Visa for International Candidates on Job Bank

Important Security Tips:

- Verify Website Security: Always ensure the website is directed to the Controller E-Payslip Portal.

- Do Not Share Credentials: Never give your login credentials to anyone.

Importance of Downloading Your Payslip Monthly:

- Documentation: Often required for various official documents.

- Convenience: Having a recent payslip ready saves time and effort.

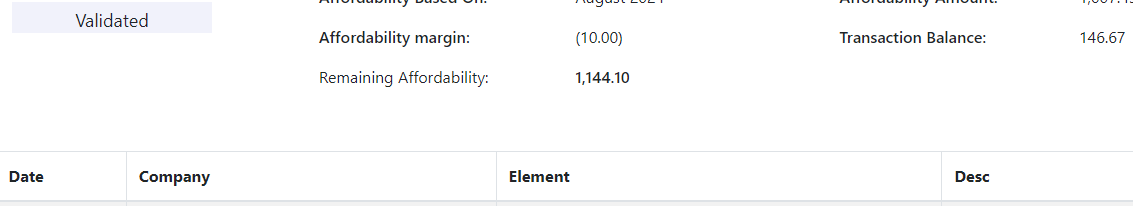

- Accuracy: Ensures your monthly earnings and deductions are correct.

Where to Save Your Payslip:

- Google Drive: Highly recommended for its reliability and accessibility on any device. If you have a Gmail account, you already have access to Google Drive.

Regular Monitoring:

- Identify Errors: By reviewing your payslip each month, you can spot and correct any unforeseen deductions or errors.

- Security: Regularly checking your payslip helps detect unauthorized activities, allowing you to protect your account and finances promptly.

Additional Resources:

- Password Recovery: How do I recover my E payslip password

- Login Assistance: E-Payslip Login

- Payslip Checking: Check My Payslip

- CAGD Payslip Login: CAGD Payslip Login

- Salary Payslip: Salary Payslip

- Online Access: E-Payslip Online

- Download App: E-Payslip App

- SM E-Payslip: SM E-Payslip

- Payroll Processes: Standard Payroll Operating Processes CAGD for Public Sector Workers